Ura motor vehicle tax calculator

slot24h kallavediUganda Revenue Authority - URA. Motor Vehicle Calculator. Vehicle Type*. ESTATE/STATION WAGON GOODS VEHICLE TRACTOR HEAD TRAILER. ESTATE/STATION WAGON. Applicable Currency*. CIF …. Easy To Use Tax Calculator | Access Our Calculator Toolcopper water bottle 오구라 유나av

. Motor Vehicle Import Tax; PAYE; Rental Tax for Individuals; Advance Motor Vehicle Tax. Compute Motor Vehicle Import Tax - Uganda Revenue Authority. Compute Motor Vehicle Import Tax. Motor Vehicle Calculator. Vehicle Type *. UNSUPPORTED VEHICLE. Applicable Currency *. CIF Value *. Seating Capacity *. …. MOTOKA UG:Vehicle Import Taxes in Uganda made easy!!. Welcome to Motoka UG. Easy to use online calculator. Immediate Results!! Based on make, model and year of car. Official URA Valuations and Taxes. Official URA …. Motor vehicle Value Guide - Uganda Revenue Authority. Go to the URA web sitepigeon compact powder the d"amelio show qartulad

. ww.ura.go.ug. 2. Click on “Compute Tax.”. 3cfare jane reaksionet kimike არდადეგები

. Select Motor Vehicle Import Tax. 4. Click “Click here to compute motor vehicle …. 3 URA Vehicle Tax Calculators To Use. Before using any of the available URA tax calculators, make sure that you have some of the information below; The motor vehicle make and model; Year of manufacture; CIF (Cost, Insurance, and Freight) …. How to Calculate Taxes on Cars (Used or New) in Uganda - Ug …. Fortunately, the Uganda Revenue Authority (URA) offers an online car tax calculator that can help you estimate the taxes you may have to pay on a specific …. Tax Services - Uganda Revenue Authority. This is a tool that helps a taxpayer ascertain their tax liability. This calculator can be used to arrive a tax payable of the selected tax heads. Click here for your motor vehicle …مستورد perawan atau janda mp3 wapka

. Uganda Revenue Authoritycuaca hari ini bachok ból po prawej stronie brzucha po alkoholu

. Quickly get answers to your Tax questions using the Interactive Tax Assisstant. Service Desk Help

magazin a louer halit özgür sarı ilayda alişan sevgili mi

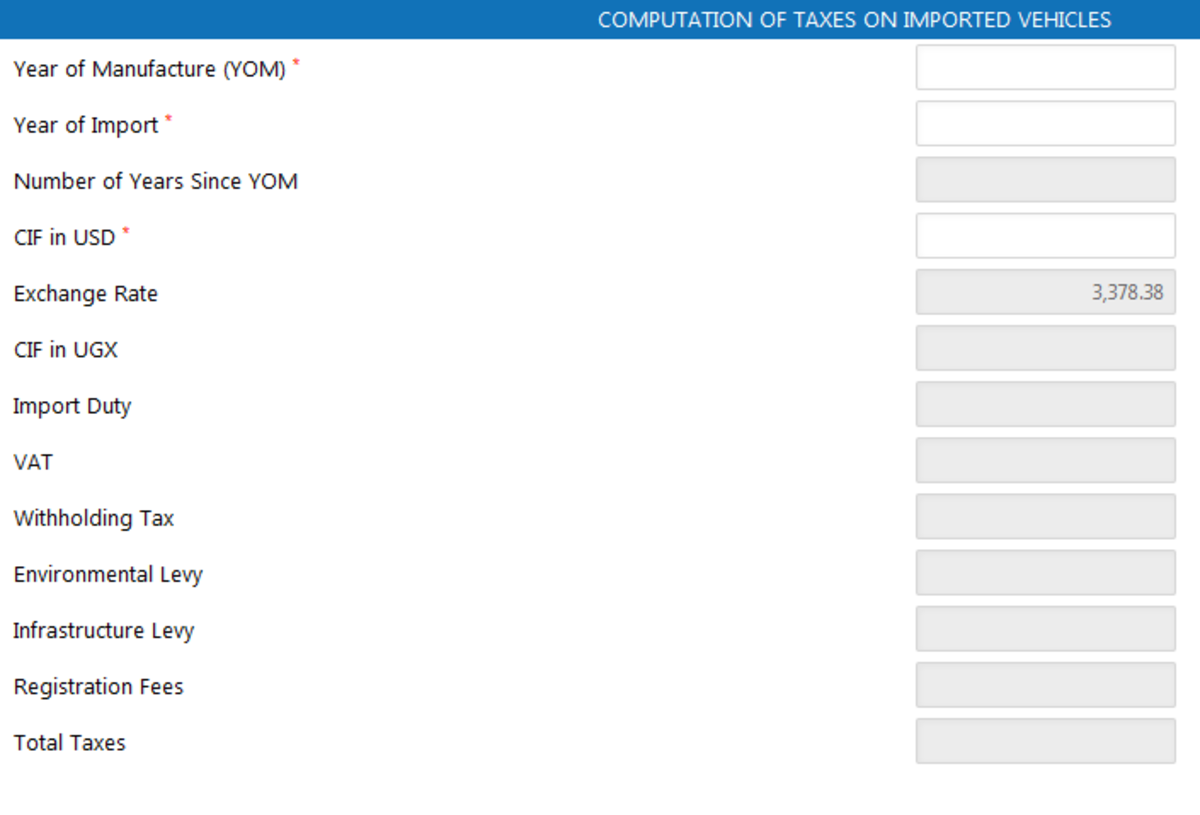

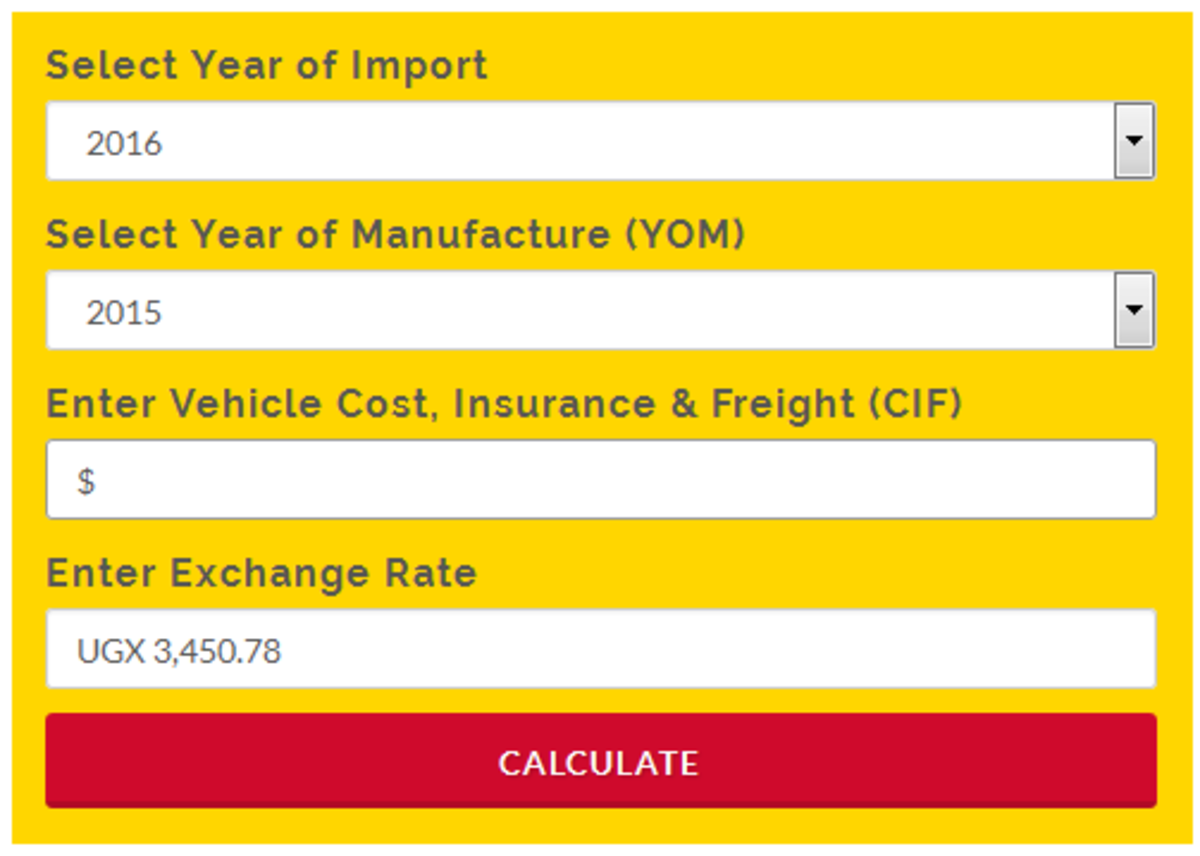

. From the table below, …. Motor vehicle validation and transfer – The Taxman. October 24, 2022 Motor vehicle validation and transfer VALIDATION OF MOTOR VEHICLES This is a process where a taxpayer captures details of the old log book into …. How to Calculate Uganda Revenue Authority Car Taxes. Japanese Used Cars TOP > BLOG > Professional Car Knowledge > Regulations & Importation > How to Calculate Uganda Revenue General Machine …. Customs Valuation – The Taxman - URA. NB: URA provided a motor vehicle tax calculator to ease the calculation of taxes on motor vehicles.This can be accessed on the URA web portal, ra.go.ug under tax tool >> motor vehicle calculator.. URA Advance Tax For Motor Vehicle

sucrate gel nə üçündür smart collection

. File Size 405.58 KB. File Count 1. Create Date March 21, 2023. Last Updated March 21, 2023. Add to Bookmarks (0) How do you find this resource?. View Vehicle Search Report - Uganda Revenue Authority. Contact Us. Toll Free: 0800 117 000 / 0800 217 000. Help: Click here for HELP/SUPPORT. Report Tax Evasion: +256 (0)323442055. Email: [email protected]. WhatsApp: 0772140000. Headquarters Address: Show. Uganda Revenue Authority Headquarters, Plot M193/M194, Nakawa Industrial Area.. Motor Vehicle Import Duty - KRA - Kenya Revenue Authority. Individual /. Calculate Tax /. Get the Right Figure /

raden99 aloe vera gel po opalovani

. Used Motor Vehicle Valuation System - Used Motor Vehicle …. Select Vehicle Details below to Calculate Value. Make. Model & Body. Year Of Manufacture

galaxy a03s price in uganda chimichurri tempero

. Your Tax will be determined according to the Cost Insurance & Freight Tax Invoices, Year of Car Manufacture, and the Capacity of the Engine Consumption (the CCs). You then be required to pay 25% Import Duty, 18% VAT, 6% Withholding Tax, 20% Environmental levy, Infrastructure Levy, and Car Registration Fees.. URA Instant Motor Vehicle Details Search Online. How to perform URA instant motor vehicle details search online. – Log onto the URA web portal ra.go.ug. – Click on e-Services and wait for the page to load. – Click on Search and Certification under Motor Vehicle. – Fill in all required details about you who is searching under applicant details and click next.. The Process of calculating the total cost of a car when imported to .. URA Motor Vehicle Calculator Disclaimer: The purpose of this calculator is to give you an indication of taxes payable for USED motor vehicles. These values are dependent on factors that may vary from time to time, such as the CIF (which is as per the Used Motor Vehicles Indicative Value Guide, available under Tax Topics A-Z under …. Tanzania Revenue Authority - Calculators & tools - TRA. The launching of Longido Clean Water Project in Arusha. This project has been facilitated by taxpayers through tax payments